Canada has published a framework for sustainable investing that outlines activities it considers consistent with the country’s climate targets. But some of the guidelines could prolong the life of polluting industries, experts said.

The taxonomy report, produced by Canada’s Sustainable Finance Action Council (SFAC) and published today by the Department of Finance, approves investment in two different categories for activities considered consistent with meeting the country’s climate targets.

A ‘green’ label is awarded to activities that emit little or no carbon, such as solar and wind, or activities that enable them, such as hydrogen pipelines.

Unlike the EU’s taxonomy, which was formalised last year, Canada does not give a green investment label to nuclear and gas. Those definitions opened the EU up to a swathe of ongoing legal challenges by NGOs and European governments.

Canada’s is also one of the first taxonomies in the world to set criteria for ‘transition’ activities, which aim to decarbonise emission-intensive activities.

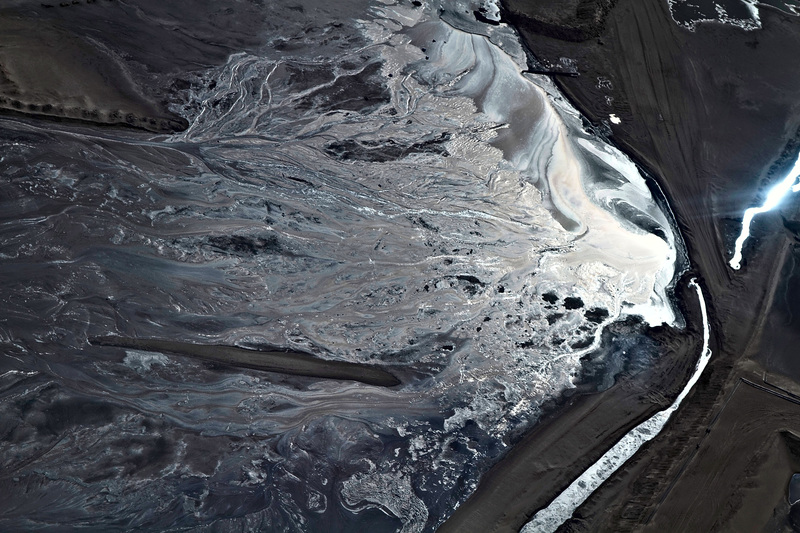

The document excludes investment in new coal, oil and gas projects, but it does potentially include carbon capture and storage (CCS) upgrades to oil sand production, concrete production with sequestration, blue hydrogen production and electrification of steelmaking.

European Commission endorses fossil gas as ‘transition’ fuel for private investment

The report says all investment activities need to be consistent with Canada’s target to be net zero by 2050 and must address scope 1, 2 and 3 emissions.

Some of its authors say it will reduce uncertainty in the market and fill a $115-billion-per-year spending shortfall needed to meet the country’s climate goal.

“It’s been great to see the 25 financial institutions sign on and endorse this framework,” said Jonathan Arnold, research lead for clean growth at the Canadian Climate Institute who provided advice on climate science for the taxonomy.

‘Endorsement for greenwashing’

But Adam Scott, director of Canadian non-profit Shift Action for Pension Wealth and Planet Health, said some of the transition activities listed do not have a “credible” decarbonisation route.

“Steel and cement and fertiliser and other hard-to-decarbonise industries will need continued finance to make a transition, but there’s a credible argument that they have a pathway or they could reach their emissions through technology.

“If you continue to finance oil and gas, though, you’re actually delaying the transition. You’re essentially saying: ‘We’re going to bet against electrification by making marginal emissions reductions which have no path to zero’.”

Governments sworn to secrecy on ‘$20bn’ for Indonesia’s energy transition

Julie Segal, climate finance senior manager at Environmental Defence, said the taxonomy gives a helping hand to Canada’s oil sands and promotes the dubious use of methane-derived blue hydrogen, which scientists say is potentially dirtier than burning fossil gas.

The taxonomy could also have international implications. Segal said it would weaken the OECD’s definition of transition, which rules out emissions-intensive lock-in. And, given the size of Canada’s pension funds, could muddy the waters globally as an “endorsement for greenwashing”.

Arnold recognised these concerns, and said the transition label should not lead to a lock-in of emissions or extend the fossil fuel industry’s social licence. “At the end of the day, [you want to] have a framework that’s credible and scientifically robust.”

He contended that there is no blanket approval for particular activities, saying investment decisions on projects will be made on an individual basis. There are strict criteria for meeting these, he added, although the thresholds have not yet been set.

‘Differences of opinion’

The taxonomy has been in development for several years, led initially by the Canadian Standards Association (CSA), but hit a roadblock due to “fundamental differences of opinion”.

Scott said that project was aimed at legitimising Canada’s carbon-intensive resource industries and was “basically a private table with banks and other financial institutions” to draw up a voluntary taxonomy.

The federal government subsequently took over under the banner of the SFAC, but some groups fear it is still over-represented by the finance and resource sectors and did not allow civil society or climate experts to make meaningful contributions.

“We’ve been complaining since it was created that that’s self regulation,” said Scott. “Essentially, the industry is able to create its own rules through the SFAC and present them directly to the finance minister.”

“The process for drafting this taxonomy has been much weaker than in the EU,” agreed Segal.

She said prime minister Justin Trudeau should be paying attention to this given his efforts to position Canada as a global climate leader.

Scott said the lack of consultation and transparency in developing the taxonomy meant the end result would lack legitimacy.

But Arnold noted that Canada had been “playing catch up” as one of the last wealthy countries to develop a taxonomy. “It’s a difficult balancing act between moving very quickly on this and and doing robust engagement and I think the process was largely successful in that regard.”

He said the process would now be taken over by a taxonomy council, led by regulators with civil society having more of a voice alongside the financial sector. That, he said, would work out the remaining details and hopefully address all the “valid concerns that have been raised”.