Lidy Nacpil is coordinator of the Asian Peoples’ Movement on Debt and Development (APMDD).

Many countries in the Global South are burdened with huge public debts. These rising debts are a drain on public resources that are urgently needed for sustainable development programmes, and further pressure Southern governments to prioritise debt service over climate actions.

Global South countries allocate more funds for debt service – 65% in lower- income countries and 14% in lower-middle-income countries – than their combined budgetary spending for education, health and social protection.

Included among the public debts of Global South countries are those from projects tainted with fraud and whose negative impacts on people, economies and the planet far outweigh the benefits, if any. Furthermore, many debts arose from projects that did not involve democratic consultations nor the free, prior and informed consent of affected communities including indigenous peoples. Prime examples of these debts are those arising from or related to fossil fuel projects. These debts should be seen and treated as illegitimate.

World Bank climate funding greens African hotels while fishermen sink

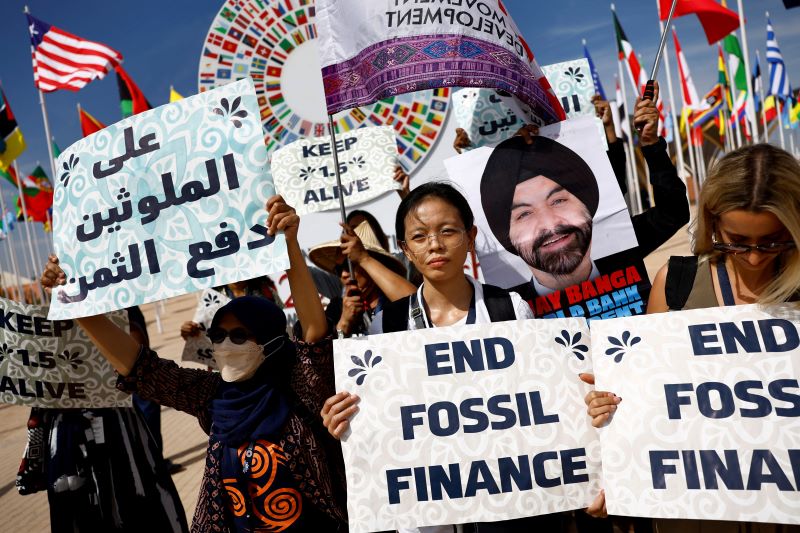

For several decades, international financial institutions and public finance institutions have lent hundreds of billions of dollars to Southern governments to support fossil-fuel energy projects. Many of the loans extended by the World Bank, Asian Development Bank (ADB), and other public finance institutions such as the Japan Bank for International Cooperation (JBIC), remain part of the current outstanding public debts.

There is already a clear consensus among governments and many public financial institutions that fossil fuel energy – from its extraction, production and consumption – is the main driver of climate change.

This is evidenced by outcomes from the Conference of Parties (COPs) summits of the UN Framework Convention on Climate Change, calling for the phase-out or transition away from fossil fuels, as well as outcomes from G7 and G20 summits committing to the phase-out of fossil fuel subsidies. Individual governments including China and Korea, have announced decisions to stop their financing of overseas coal projects. Further evidence is in the decisions made by public financial institutions to stop or phase out financing of coal and fossil fuels.

These decisions, commitments and policy shifts should be taken as acknowledgement of their co-responsibility in the promotion of fossil fuels and the harms fossil fuel projects have caused to people, communities, the environment and climate systems.

Owning up to their co-responsibility for fossil fuel projects and their impacts, and consistent with their avowed commitments to combat climate change, governments and public financial institutions, including international financial institutions, should cancel all outstanding public debts that arose from fossil fuel projects. These outstanding debts may be transformed into grants for renewable energy systems.

UN climate chief calls for “quantum leap in climate finance”

The same can be said for private banks, financial and investment institutions and corporations that have lent money to governments for fossil fuel projects. Many have also recognised fossil fuels as the main drivers of climate change and have shifted their policies towards reducing or phasing down their lending and investments in coal and fossil fuels.

From April 17 to 19, the IMF and the World Bank (IMF-WB) will hold their Spring Meetings in Washington D.C. These meetings take place amidst an ever-worsening debt crisis, most harshly felt by 3.3 billion people living under governments that spend more on interest payments than education or health.

Bankruptcy risk from climate spending

A new report released on the eve of the meetings found that developing countries will pay a record $400 billion to service external debt this year. It said climate spending could bankrupt developing countries due to huge debt costs and called for debt forgiveness for those most at risk. The report from the Debt Relief for Green and Inclusive Recovery Project (DRGR) warned 47 developing nations would reach external debt insolvency thresholds in the next five years if they invested the necessary amounts to meet the 2030 Agenda and Paris Agreement goals.

Spring Meetings can jump-start financial reform for food and climate

It is deplorable that the IMF-WB continues to push loans as the solution to multiple crises facing developing countries, including loans for climate action. At the height of the COVID-19 pandemic, when financial resources were most urgently needed, they supported and promoted the debt relief schemes of the G20 and Paris Club for the mere postponement of debt payments. These have all but proven flawed and futile. The suspended payments fall due in 2025 – by which time debt accumulation will have sped up even more. Private and commercial lenders, who now hold over 60% of sovereign debt, remain free to refuse participation in debt reduction.

Total public debt, domestic and external, reached $92 trillion in 2022, increasing five-fold since 2000. Southern governments account for almost one-third of the total debt and are accumulating debt much faster than their richer counterparts. The number of countries with public debt levels exceeding 60% of GDP continues to rise, from 22 in 2011 to 59 in 2022. The long-term public external debts alone of low- and middle-income countries, excluding China, amount to a staggering $3.3 trillion.

The consequences of World Bank projects, coupled with IMF neoliberal, policies have been devastating for vulnerable communities in the Global South. Large-scale infrastructure projects financed by the World Bank have led to displacement of communities, loss of livelihoods and destruction of ecosystems, and in the process, deepened inequality and impoverishment. Its fossil fuel subsidies and project loans impacted communities already struggling to survive economic hardships and environmental degradation. It also continues to subsidise the fossil fuel industry through direct and indirect financing, estimated at $885 million in 2022 and at least $194 million in 2023.

The World Bank and the IMF, now in their eighth decade of committing to fight poverty, have yet to account for loans that are clearly illegitimate and must be canceled outright, nor for harsh loan conditionalities that have deepened inequality and impoverishment.